|

Vol. 3, Issue #14 August 1st - August 14th, 2008

The Faulking Truth Silver State Bank: What's Deposited in Vegas Doesn't Stay in Vegas By: Mark Faulk

"When the casinos treat you poorly, let Silver State treat you like a valued customer." In yet another bizarre development in the saga of CMKX, one of the largest financial frauds in history, Andrew McCain, the son of presumptive Republican presidential candidate John McCain, resigned from the Board of Directors of Silver State Bank, headquartered in Henderson, Nevada. Almost immediately, the internet began buzzing with rumors and stories, mostly either questioning Silver State’s financial condition or drawing the inevitable comparison to his father’s involvement twenty years ago in the infamous “Keating 5” savings and loan scandal, where federal regulators seized Lincoln Savings and Loan Association of Irvine, California. The senior McCain was rebuked by the Senate Ethics Commission, who concluded that he had and four other senators had tried to hold off a government investigation into the savings and loan’s risky real estate deals. Lincoln’s chairman at the time was Charles Keating, who was not only one of McCain’s top donors, but was a business partner with Cindy McCain. But the younger McCain, who had only been with Silver State Bank for a little over four months after Choice Bank, where McCain was director, was taken over by Silver State, might have to answer questions of his own. Silver State Bank has its own history of problems. Just two months ago, one of the bank’s executive vice-presidents resigned after the company reported a massive loss for the first quarter of 2008, which the company blamed largely on the deteriorating real estate market. The bank recently announced plans to raise an additional $40 million in capital, which could be a problem, since their share price has dropped over 95% in the past year, from a high of $19.48 to July 29th’s closing price of $1.18. Their market cap has fallen from $275 million to less than $17 million. At today’s closing price, that $40 million in additional capital will more than triple the company’s current number of outstanding shares. There’s more…a lot more. Andrew McCain served on the bank’s Audit Committee, which means his responsibilities included, according to the company’s bylaws, an understanding of finance and accounting: “All of the members of the Audit Committee must have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements. At least one member of the Audit Committee must be an audit committee financial expert, as determined by the Board, consistent with the applicable rules and regulations of the Securities and Exchange Commission and the applicable rules and regulations of the stock exchange on which the Corporation’s shares are listed.” But a little diamond mining company from Canada that turned out to be the biggest penny stock fraud in history might become a major problem for McCain’s campaign as well. Insiders with CMKM Diamonds, better known as CMKX, defrauded over 50,000 shareholders of in excess of $250 million. A large portion of that money was run through a single Silver State Bank branch in Las Vegas. In all, former CMKX CEO Urban Casavant and reputed mastermind John Edwards (no, not that John Edwards) opened over 100 bank accounts at Silver State, and ran tens of millions of dollars through the bank.

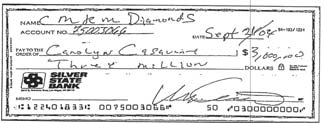

This was not an isolated case, but was instead the normal way of doing business with Casavant, Edwards, and their cohorts. It was an incredible whirlwind of activity for Silver State Bank and other Las Vegas banks, including Wells Fargo, Nevada State, and Sun West Bank. Hundreds of checks, wire transfers, and deposits totaling tens of millions and possibly hundreds of millions of dollars flowed like champagne in the Vegas casinos. Among the transactions executed by Silver State Bank: • Wire transfers totaling hundreds of thousands of dollars were executed with only the notation “transferring to Personal Acct. per cust. transfer via phone”. • Checks from the CMKXtreme account written out only to “CASH”…including one for $350,000. • Multi-million dollar wire transfers between Edwards and Urban, run through one of the almost 100 accounts they controlled there. • Millions of dollars written out of company accounts to Urban, his wife Carolyn, and several family members, often on temporary checks.

They have since filed numerous lawsuits against Edwards, Casavant, and others, and have subpoenaed records from Silver State Bank and other banks associated with the scam in an ongoing effort to recover assets for the defrauded shareholders. The SEC recently filed charges against eleven individuals and three companies in the CMKX case, but a multi-year investigation by a task force comprised of the DOJ, FBI, and IRS has yet to produce any arrests or charges. Silver State Bank has not been charged in the CMKM Diamonds case, although they did fire an employee named Patricia DeCosta, who approved most of the transactions. DeCosta in turn filed a lawsuit in early 2006 against her former employer, detailing her side of the story: “Throughout plaintiff’s employment she was encouraged to open new accounts and each ‘performance appraisal’ done with regard to her employment speaks glowingly of the number of new accounts her branch opened. That on or about the 5th day of September 2004 the bank was served with a subpoena with regard to accounts maintained at the branch plaintiff supervised. Certain executives of defendants (Silver State Bancorp, Silver State Bank) owned stock in companies controlled by the subject of the subpoena and became disconcerted when the bank was served with the aforementioned subpoena. Seeking a scapegoat the bank terminated plaintiff claiming she had not processed a suspicious activity report in a timely manner. Plaintiff was unable to timely process the SAR due to the fact that she was undergoing a ‘serious health condition’, which required her to take leave from her employment.” The fact remains that Silver State Bank never filed a single Suspicious Activities Report (SARS) while 50,000 CMKX shareholders lost their entire investments. Did Andrew McCain look into the bank’s shady past, and if so, is he now just quietly trying to slip out the side door before the building comes tumbling down? How this new twist plays out remains to be seen, but the saga of CMKX, as detailed in “The Naked Truth: The Stock Play of a Lifetime” seems to be a story that won’t go away. After years of being ignored by public officials at all levels, maybe it will take a presidential campaign to expose the seedy underbelly of corruption in our financial markets. And that….as always…is the Faulking Truth. (Mark Faulk’s first book, entitled The Naked Truth: Investing in the Stock Play of a Lifetime, is now available at www.thenakedtruthbook.com. Buy it now while you still have a few dollars in the bank. Tune in with Mark Faulk and DeWayne Reeves every Friday from 9-10 AM CST on The Faulking Truth Show, and join Mark and Paul Faulk every Saturday from 1-2 PM CST on The Faulking Truth X2 Show at www.toginet.com) Contact Mark Faulk at faulkingtruth@gmail.com Join NONzine and Mark Faulk for a book signing and release party for The Naked Truth: Investing in the Stock Play of a Lifetime on August 23rd from 6:30 to 8:30 PM at the new NONfactory - 3122 N. May in Oklahoma City! |

||

©2008 NONCO Media, L.L.C.

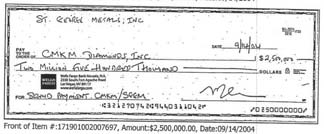

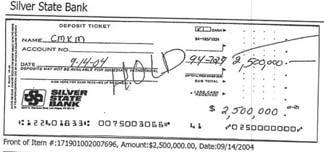

In one multi-million dollar gamble taken by Silver State Bank, they accepted not just one but four checks for $2.5 million dollars each from a fraudulent company account at Wells Fargo Bank in Las Vegas in one week…written on temporary checks. John Edwards opened an account for a company called Saint George Metals on the same day that CMKM Diamonds announced a “business partnership” with the company, which in reality was just a bank account whose only signor was John Edwards. Edwards would write a $2.5 million check to CMKM Diamonds on a temporary check from Wells Fargo, and Urban Casavant would deposit it the “official” company account at Silver State Bank and write a press release announcing the investment. In turn, money was filtered back to Edwards either in illegally issued company stock or cash, essentially making the exchange a wash. To Silver State Bank’s credit, they at least wrote “HOLD” across one of the deposits, apparently waiting for the $2.5 million temporary check to clear before crediting the CMKM Diamonds’ account.

In one multi-million dollar gamble taken by Silver State Bank, they accepted not just one but four checks for $2.5 million dollars each from a fraudulent company account at Wells Fargo Bank in Las Vegas in one week…written on temporary checks. John Edwards opened an account for a company called Saint George Metals on the same day that CMKM Diamonds announced a “business partnership” with the company, which in reality was just a bank account whose only signor was John Edwards. Edwards would write a $2.5 million check to CMKM Diamonds on a temporary check from Wells Fargo, and Urban Casavant would deposit it the “official” company account at Silver State Bank and write a press release announcing the investment. In turn, money was filtered back to Edwards either in illegally issued company stock or cash, essentially making the exchange a wash. To Silver State Bank’s credit, they at least wrote “HOLD” across one of the deposits, apparently waiting for the $2.5 million temporary check to clear before crediting the CMKM Diamonds’ account.

The scam finally came crashing down in late 2005 when the SEC finally delisted CMKX, and a shareholder named Kevin West was appointed by Urban to take over while Casavant fled to Canada. West inherited a company with no tangible assets, no real business…and $558 in the bank. Edwards, Casavant, and their cohorts had stolen the rest. West brought in Bill Frizzell, an attorney from Tyler, Texas, who had been conducting a multi-year investigation into CMKX for a shareholders’ group.

The scam finally came crashing down in late 2005 when the SEC finally delisted CMKX, and a shareholder named Kevin West was appointed by Urban to take over while Casavant fled to Canada. West inherited a company with no tangible assets, no real business…and $558 in the bank. Edwards, Casavant, and their cohorts had stolen the rest. West brought in Bill Frizzell, an attorney from Tyler, Texas, who had been conducting a multi-year investigation into CMKX for a shareholders’ group.